Life insurance is one of those financial tools that often sits quietly in the background, rarely discussed until a major life event forces it into the spotlight. Yet its importance cannot be overstated. At its core, life insurance is about building a financial shield—one that protects loved ones, preserves assets, and ensures continuity in the face of uncertainty. It’s not just a policy; it’s a promise. And understanding how it works, what it offers, and why it matters is essential for anyone looking to create a resilient financial foundation.

The basic premise of life insurance is straightforward. You pay a premium, and in return, the insurer agrees to pay a designated sum to your beneficiaries upon your death. That payout, known as the death benefit, can be used for a variety of purposes—covering funeral expenses, paying off debts, funding education, or simply maintaining the standard of living for those left behind. But while the concept is simple, the choices involved in selecting the right policy are anything but. There are different types of life insurance, each with its own structure, benefits, and trade-offs. Navigating these options requires a clear understanding of your goals and a willingness to think long-term.

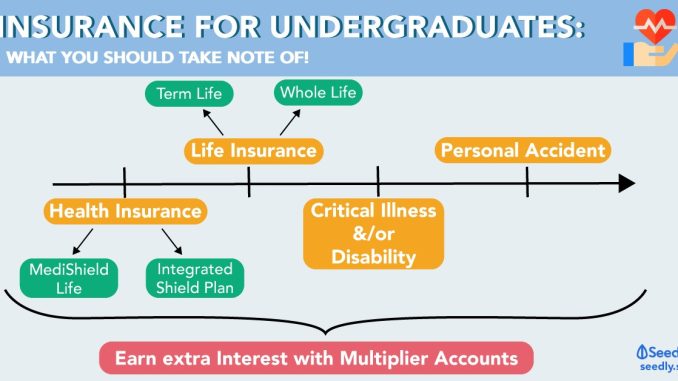

Term life insurance is often the starting point for many individuals. It provides coverage for a specific period—typically 10, 20, or 30 years—and pays out only if the insured dies during that term. Because it’s temporary and doesn’t build cash value, term life is generally more affordable than other types. It’s ideal for covering short- to medium-term needs, such as replacing income during child-rearing years or paying off a mortgage. For example, a young parent might purchase a 20-year term policy to ensure that their children are financially supported until they reach adulthood. The simplicity and cost-effectiveness of term life make it a popular choice, especially for those just beginning to build their financial shield.

Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component known as cash value. This cash value grows over time, often on a tax-deferred basis, and can be borrowed against or withdrawn under certain conditions. Whole life and universal life are two common forms of permanent insurance, each with its own nuances. Whole life provides fixed premiums and guaranteed growth, while universal life offers more flexibility in premium payments and death benefits. These policies are more expensive than term life, but they serve a different purpose. They’re often used in estate planning, wealth transfer, or as a tool for building tax-advantaged savings. For someone with long-term financial commitments or complex planning needs, permanent life insurance can be a powerful asset.

Choosing between term and permanent life insurance isn’t just a financial decision—it’s a personal one. It depends on your stage of life, your financial obligations, and your broader goals. A single professional with no dependents may opt for minimal coverage, while a business owner with family responsibilities and succession plans might require a more robust solution. The key is to align the policy with your specific circumstances, ensuring that it complements other elements of your financial strategy. Life insurance doesn’t exist in a vacuum; it works best when integrated with retirement planning, investment management, and debt reduction.

One of the most overlooked aspects of life insurance is its role in protecting against the unexpected. While no one likes to dwell on worst-case scenarios, the reality is that life is unpredictable. A sudden illness, accident, or tragedy can leave families not only grieving but financially vulnerable. Life insurance provides a buffer against that vulnerability. It allows survivors to focus on healing rather than scrambling to cover expenses. It preserves dignity, stability, and the ability to move forward. In this way, life insurance is not just about death—it’s about life. It’s about ensuring that those you care about can continue living with security and purpose.

The process of purchasing life insurance should be approached with care and clarity. It starts with assessing your needs—how much coverage is appropriate, who should be the beneficiaries, and what type of policy fits your budget and goals. Working with a knowledgeable advisor can make a significant difference. They can help you navigate the options, explain the fine print, and tailor the coverage to your unique situation. Transparency is crucial, both in disclosing health information and in understanding the terms of the policy. Misunderstandings can lead to denied claims or inadequate protection, so it’s worth investing time in getting it right.

Life insurance also evolves over time. As your life changes—marriage, children, career shifts, retirement—your coverage should adapt. What made sense a decade ago may no longer be sufficient. Regular reviews ensure that your financial shield remains strong and relevant. Adjusting beneficiaries, increasing coverage, or converting a term policy to permanent are all part of maintaining a dynamic and responsive insurance strategy. It’s not a one-time decision; it’s an ongoing commitment to financial stewardship.

Ultimately, life insurance is about peace of mind. It’s about knowing that you’ve taken steps to protect those you love, to preserve what you’ve built, and to create a legacy that endures. It’s not just for the wealthy or the cautious—it’s for anyone who values responsibility, foresight, and care. Building a financial shield through life insurance is one of the most profound expressions of that care. It’s a quiet but powerful way to say, “I’ve thought ahead. I’ve planned for you. I’ve made sure you’ll be okay.” And in a world full of uncertainties, that kind of assurance is truly invaluable.