In today’s competitive labor market, attracting and retaining top talent requires more than just offering a competitive salary. Employees are increasingly looking for comprehensive benefits packages that support their overall well-being, and insurance plays a pivotal role in that equation. For employers, leveraging insurance as a strategic tool can make a significant difference in how their company is perceived and how appealing it is to prospective hires. Insurance isn’t just a safety net—it’s a signal of care, stability, and long-term investment in people.

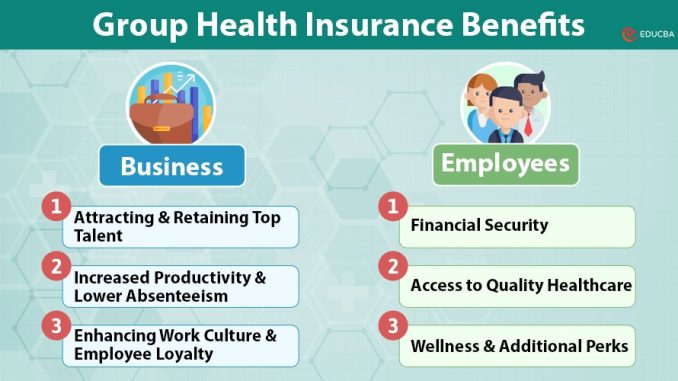

When candidates evaluate job offers, they often look beyond the paycheck. They consider what kind of life they’ll be able to build with the support of their employer. Health insurance, for example, is one of the most valued benefits across industries. Offering robust health coverage communicates that a company is serious about employee welfare. It shows that the organization understands the financial and emotional burden that medical issues can impose and is willing to shoulder part of that responsibility. This kind of support can be especially persuasive for candidates with families, chronic health conditions, or those who are simply planning for the future.

But health insurance is just the beginning. Dental, vision, life, and disability insurance all contribute to a sense of security that employees crave. When these benefits are thoughtfully bundled and clearly communicated, they can transform a job offer from “good” to “irresistible.” For instance, a company that includes short-term disability coverage may appeal to younger professionals who are thinking about starting a family. Meanwhile, life insurance can resonate with mid-career candidates who are focused on protecting their dependents. These offerings aren’t just perks—they’re reflections of a company’s values and priorities.

The way insurance benefits are presented also matters. Transparency and clarity go a long way in building trust. Employers who take the time to explain coverage options, out-of-pocket costs, and enrollment processes demonstrate respect for their employees’ time and intelligence. This kind of communication can start as early as the recruitment phase. Including a benefits overview in job postings or during interviews can set a company apart from competitors who treat insurance as an afterthought. It’s not just about what you offer—it’s about how you talk about it.

Customization is another powerful strategy. Not all employees have the same needs, and a one-size-fits-all approach can fall flat. Offering flexible insurance plans or cafeteria-style benefits allows individuals to choose what works best for them. This personalization can be especially attractive to younger workers who may not need extensive coverage but appreciate the freedom to tailor their benefits. It also shows that the company is listening and adapting to the diverse realities of its workforce.

Moreover, insurance benefits can be a tool for reinforcing company culture. A business that prioritizes mental health might offer access to therapy or counseling services through its health plan. One that values financial literacy could include supplemental life insurance or long-term care options. These choices send a message about what the company stands for and how it supports its people beyond the workplace. In this way, insurance becomes part of the brand identity—something that employees can feel proud to be associated with.

Retention is another critical piece of the puzzle. While insurance can attract new employees, it also plays a major role in keeping them. Workers who feel secure and supported are less likely to seek opportunities elsewhere. They’re more likely to invest in their roles, contribute to team cohesion, and grow within the organization. This stability benefits everyone, reducing turnover costs and fostering a more experienced, engaged workforce.

It’s also worth noting that insurance offerings can be a differentiator in industries where competition for talent is fierce. In tech, for example, where startups and giants alike vie for skilled professionals, a comprehensive benefits package can tip the scales. Similarly, in healthcare or education, where burnout is common, insurance that covers mental health services or wellness programs can be a game-changer. These benefits aren’t just nice to have—they’re essential tools for building a resilient and motivated team.

Employers should also consider how insurance intersects with broader trends in work culture. Remote work, for instance, has changed how people think about access to care. Offering telehealth services or nationwide coverage can make a company more attractive to remote employees. Likewise, as younger generations enter the workforce, there’s growing interest in preventive care and holistic wellness. Insurance plans that include gym memberships, nutrition counseling, or alternative therapies can resonate with these values and help companies stand out.

Ultimately, using insurance to attract employees is about more than ticking boxes. It’s about crafting a benefits experience that aligns with the company’s mission and meets the real needs of its people. It requires thoughtful planning, clear communication, and a genuine commitment to employee well-being. When done right, insurance becomes a powerful recruitment tool—one that not only brings talent through the door but helps them thrive once they’re inside.