Using the debt avalanche method is a strategic way to tackle outstanding balances with efficiency and long-term savings in mind. It’s designed to minimize the total interest paid over time, making it particularly appealing for individuals who carry multiple debts with varying interest rates. Unlike other approaches that focus on psychological wins or quick progress, the debt avalanche method prioritizes financial optimization. By directing extra payments toward the highest-interest debt first while maintaining minimum payments on all others, this method accelerates debt reduction and helps borrowers regain control of their financial future.

The process begins with a clear understanding of your debt landscape. That means listing all your debts, including credit cards, personal loans, student loans, and any other liabilities, along with their respective balances, interest rates, and minimum monthly payments. The key is to identify which debt carries the highest interest rate, regardless of the balance size. This becomes your primary target. For example, if you have a credit card with a 22 percent interest rate and a personal loan at 10 percent, the credit card takes priority under the avalanche method. The logic is simple: the higher the interest rate, the more costly the debt over time.

Once you’ve identified your highest-interest debt, the next step is to allocate any extra funds toward that account while continuing to make minimum payments on the rest. This requires discipline and consistency. Even small additional payments can make a significant impact when applied to high-interest debt. As that balance decreases, the amount of interest accrued each month also drops, allowing more of your payment to go toward the principal. Over time, this accelerates the payoff process and frees up cash flow that can be redirected to the next highest-interest debt.

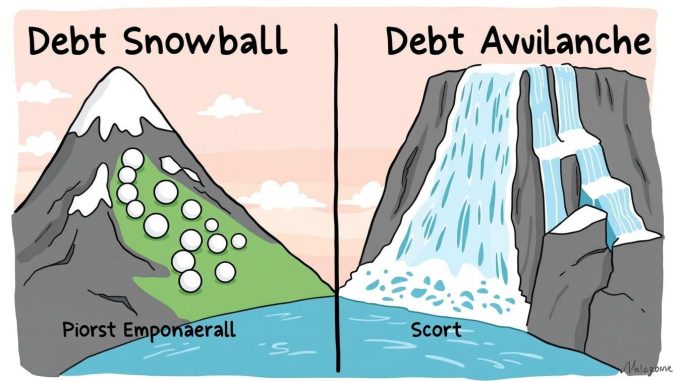

One of the strengths of the debt avalanche method is its mathematical efficiency. By focusing on interest rates rather than balances, you reduce the overall cost of borrowing. This can be especially powerful for individuals with large credit card balances or payday loans, which often carry exorbitant interest rates. While it may take longer to see progress compared to methods like the debt snowball, which targets the smallest balances first, the avalanche method delivers greater savings in the long run. It’s a strategy that rewards patience and persistence, and it’s particularly well-suited for those who are motivated by financial logic rather than emotional milestones.

Budgeting plays a crucial role in the success of the debt avalanche method. Identifying areas where you can cut expenses or increase income allows you to maximize the amount available for debt repayment. This might involve reducing discretionary spending, negotiating bills, or taking on freelance work. The more you can contribute beyond the minimum payments, the faster your avalanche gains momentum. It’s also important to avoid accumulating new debt during this process. Using credit cards sparingly or switching to cash-based spending helps prevent setbacks and keeps your focus on eliminating existing balances.

Tracking progress is essential to staying motivated. While the avalanche method doesn’t offer the immediate gratification of eliminating small debts quickly, it does provide measurable financial benefits. Watching your interest charges decrease and your principal shrink can be incredibly satisfying. Using spreadsheets, budgeting apps, or financial dashboards can help you visualize your progress and stay committed. Some people find it helpful to set milestones or celebrate when a particularly burdensome debt is paid off. These moments of achievement reinforce your efforts and remind you of the value of sticking to the plan.

Communication is also important, especially if you share financial responsibilities with a partner or family member. Aligning on goals, strategies, and spending habits ensures that everyone is working toward the same outcome. Transparency about income, expenses, and debt obligations fosters trust and collaboration. In some cases, it may be beneficial to consult a financial advisor or credit counselor to refine your approach and address any challenges. Professional guidance can provide clarity and confidence, especially when navigating complex debt situations or considering consolidation options.

The debt avalanche method is not a quick fix, but it is a powerful tool for long-term financial health. It requires commitment, planning, and a willingness to prioritize efficiency over instant results. For those who stick with it, the rewards are substantial—not just in terms of money saved, but in the sense of control and freedom that comes from being debt-free. As each high-interest account is eliminated, your financial burden lightens, and your ability to invest, save, or pursue other goals expands. It’s a journey that demands focus, but the destination is well worth the effort.

Ultimately, using the debt avalanche method is about making smart, intentional choices with your money. It’s about recognizing that not all debt is created equal and that tackling the most expensive obligations first can lead to faster, more sustainable progress. Whether you’re dealing with a handful of credit cards or a mix of loans, this method offers a clear, effective path forward. With consistency and determination, you can transform your financial landscape and build a future that’s not defined by debt, but by opportunity.