In the complex landscape of healthcare, the primary role of health insurance is to provide a vital financial safety net, ensuring access to necessary medical care without crippling costs. However, even with seemingly robust coverage, the reality for many policyholders can involve the frustrating and often financially burdensome experience of a health insurance claim denial. This isn’t merely an administrative inconvenience; it can mean significant out-of-pocket expenses for vital medical services, causing considerable stress and anxiety. For the discerning individual, approaching this challenge with the same methodical tenacity applied to navigating a business dispute, understanding “What to Do When You Have a Health Insurance Claim Denial” is paramount to asserting your rights and ultimately securing the coverage you are entitled to.

A health insurance claim denial occurs when your insurer refuses to pay for a medical service or treatment that you or your provider submitted for reimbursement. The reasons for denial can vary widely, ranging from simple administrative errors to more complex disputes over medical necessity or policy exclusions. Regardless of the reason, a denial can leave you feeling powerless and overwhelmed, especially when facing mounting medical bills. The key to successfully appealing a denial lies in a systematic and persistent approach, much like conducting a thorough audit to uncover discrepancies.

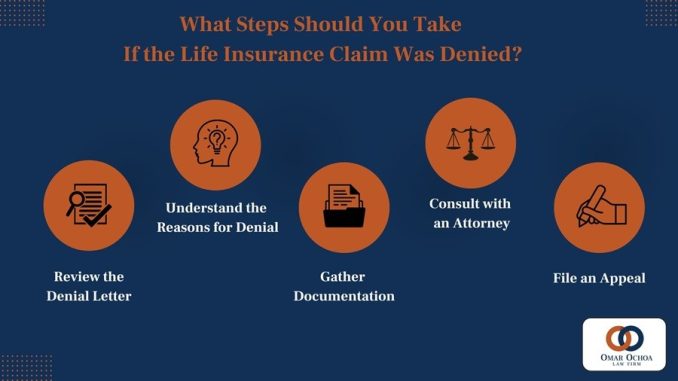

The absolute first step upon receiving a denial is to **understand precisely why your claim was denied**. Do not simply accept the denial notice at face value. Insurers are legally obligated to provide a reason for their decision. This explanation will typically be detailed in an “Explanation of Benefits” (EOB) or a formal denial letter. Common reasons for denial include:

* **Coding Errors:** Incorrect or incomplete medical codes submitted by the healthcare provider.

* **Missing Information:** Insufficient documentation or details from the provider.

* **Not Medically Necessary:** The insurer deems the service or treatment not essential for your condition based on their guidelines.

* **Not Covered Service:** The specific service is explicitly excluded from your policy (e.g., cosmetic procedures, experimental treatments).

* **Out-of-Network Provider:** You received care from a provider not in your plan’s network, and it wasn’t an emergency.

* **Pre-authorization Lacking:** A required pre-approval for a specific procedure or medication was not obtained.

* **Pre-existing Condition:** The insurer claims the condition existed before coverage began and is excluded (less common in fully compliant markets, but a factor in some plans or international policies).

* **Timely Filing Limits:** The claim was not submitted within the insurer’s specified timeframe.

Carefully review this stated reason. If it’s a simple administrative error or missing information, contact your healthcare provider’s billing department immediately; they can often resubmit the claim with corrections. If the reason is more complex, such as “not medically necessary” or “not covered service,” you’ll need to prepare for a more formal appeal.

The second critical step is to **gather all relevant documentation**. This is your evidence. Collect copies of:

* Your insurance policy document and Summary of Benefits and Coverage (SBC), paying close attention to sections on covered services, exclusions, and appeals processes.

* The denial letter/EOB with the reason for denial.

* All medical records related to the denied service, including doctor’s notes, test results, diagnoses, and treatment plans.

* Any correspondence between you, your provider, and the insurance company.

* Itemized bills from your healthcare provider.

Organize these documents meticulously, chronologically if possible. This comprehensive packet will serve as your ammunition during the appeal process, much like a well-prepared dossier in a legal case.

Next, initiate the **internal appeals process**. This is your right under most insurance regulations. Your denial letter should outline the steps for an internal appeal. Typically, this involves submitting a written appeal letter to your insurance company. Your letter should be clear, concise, and professional, including:

* Your name, policy number, and contact information.

* The claim number and date of service.

* A clear statement that you are appealing the denial.

* A detailed explanation of why you believe the decision should be overturned, citing specific language from your policy if applicable, and referencing your medical records to demonstrate medical necessity.

* Any supporting documentation you’ve gathered.

* A request for a written response detailing their decision and further appeal rights.

Send your appeal via certified mail with a return receipt requested, or use an online portal that provides a confirmation timestamp. This creates a paper trail, which is vital for accountability.

If your internal appeal is denied, you typically have the right to an **external review**. This is a powerful mechanism where an independent third-party medical review organization, not affiliated with your insurance company, reviews your case. Your insurer is bound by the external reviewer’s decision. The denial letter from your internal appeal should provide information on how to request an external review. This independent assessment ensures impartiality, offering a fresh perspective on the medical necessity or coverage dispute.

Throughout this process, **maintain meticulous records of all communications**. Note down dates, times, names of individuals you spoke with, and a summary of the conversation. Keep copies of every letter, email, and fax sent and received. This detailed log is invaluable if you need to escalate your appeal or seek external assistance.

Consider seeking **professional assistance**. Navigating claim denials can be complex and emotionally draining. Patient advocates, state departments of insurance (or their equivalent in Thailand, like the Office of Insurance Commission – OIC), or legal aid organizations can provide invaluable guidance, help you understand your rights, review your documentation, and even assist in drafting appeal letters. For complex cases, particularly those involving large sums or significant ongoing treatment, consulting with an attorney specializing in insurance law might be a necessary strategic step.

Finally, **learn from the experience**. While denials are frustrating, they offer valuable insights into your policy’s nuances. Once the claim is resolved, review your policy again, perhaps with an insurance agent, to understand any limitations or exclusions more clearly. Consider if your current policy still meets your needs or if a different plan would offer more robust coverage for your specific health profile, especially if you have recurring conditions. This proactive approach ensures that future healthcare costs are better managed, reflecting a business strategy that learns from challenges and adapts for future resilience.

In conclusion, a health insurance claim denial is not the final word. It is a challenge that, while demanding, can be effectively overcome with a systematic, informed, and persistent approach. By understanding the reasons for denial, meticulously documenting your case, diligently pursuing internal and external appeals, and seeking professional assistance when necessary, you empower yourself to assert your rights and secure the coverage you deserve. This proactive engagement transforms a moment of stress into an opportunity for financial protection, ensuring that your health remains a priority, unburdened by unforeseen medical expenses.